Some states and countries have refundable taxes collected, and these need to be reported. One reporting requirement is system calculated tax where a manually calculated tax was applied. This comparison allows errors to be defined more readily, and assists in the reconciliation process.

A new report was generated to show taxes in both forms- system calculated, and the actual manual tax applied. A customization was required to support reporting, though no change to the User Interface was made.

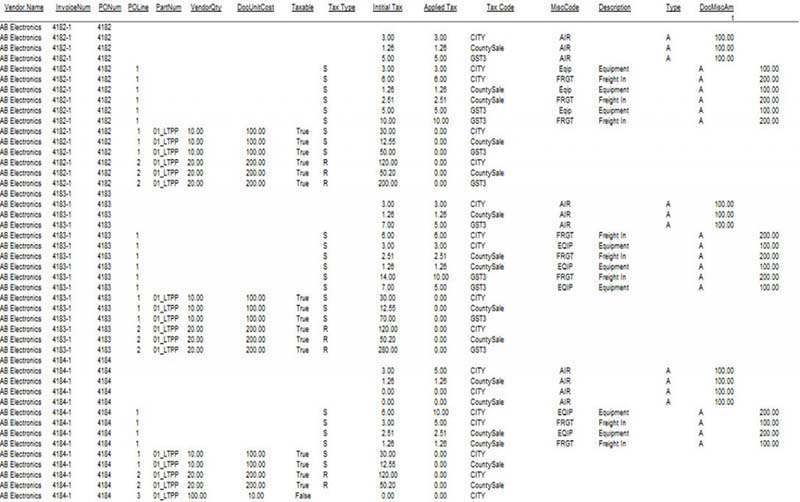

Taxes by Invoice date range

- Columns:

- Supplier

- Invoice number (where Open Payable = false)

- Invoice Date

- PO

- PO Line

- Part Number

- Supplier qty

- Unit price

- Taxable flag

- Tax Type (UD Field)

- Initial tax amount

- Applied tax amount

- Tax Code

- Misc Charge Code

- Type (A/P)

- Misc Charge Amount

- Filters

- Tax type (UD field)

- Invoice date range

Example report format: